36+ Line of credit loans for poor credit

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence using cash or liquid assetsLenders typically demand a. If you have poor credit which means having a FICO score below 580 your interest rate will likely be much higher.

2

If you have a 600 credit score you may be interested in credit cards for poor credit.

. Compare the many options and start improving your credit now. Between 1977 and 1987 the share fell from 96 to 66 while that of banks and other institutions rose from 3 to 36. All you need is proof of age income Social Security number and proof of US.

How to Calculate a Down Payment Amount. Today they have extended 14 billion in funding to. Double your credit line by making at least your minimum payment on time each month for the first 7 months your account is open.

There are currently over. Poor to excellent credit 1500 to 100000 Go to site. Credit Line Up to 1000 credit limit subject to credit approval Card Brand.

Citizenship for an emergency loan. Credit lines range from 550-1350 which double to 1100-2700 after your account qualifies. 1000-3000 based on lender.

If you have bad or poor credit as defined by FICO a score of 350 to 579 you wont be able to qualify for a personal loan unless you apply with a co-signer. If your credit score is at. Best for few fees.

Choose your own credit line based on how much money you want to put down as a security deposit. 24 and 60 months Origination fee. Double your credit line by making at least your minimum payment on time each month for the first 7 months your account is open.

OnDeck was founded in 2006 and has since been a leading provider in the business lending space offering both term loans and lines of credit. No security deposit required. No-credit-check loans usually have interest rates around 36.

25000-100000 based on lender. See if you are pre-approved within minutes without affecting your credit score. A FICO score is a type of credit score created by the Fair Isaac Corporation.

You know your credit score is in the poor range but do you know your exact score right this minute. OneMain Financial generally accepts applicants with at least a poor or fair credit score the exact credit score minimum is not disclosed but for reference a poor credit score is considered to be. Lenders will typically use this score along with other information to evaluate your ability to pay back a loan or line of credit.

PTI ratios the requirements vary by lender. 599 2499 Terms. Get considered for a credit line increase after 6 months with no additional deposit required.

Features of mortgage loans such as the size of the loan maturity of the loan interest rate method of paying off the loan and other characteristics can vary considerably. PenFeds credit line charges a fixed annual percentage rate of 1465 and includes free checks. The 14 billion Chicago-based credit union founded in 1935 is one of the.

No-credit-check emergency loans are same-day loans that you can get even with a credit score of 560 or lower. Free credit builder loans from 240 - 2400. Rates are effective as of 09012022 and reflect an automatic payment discount of either 025 for credit-based loans OR 100 for undergraduate outcomes-based loans.

Loans backed by the Federal Housing Administration can be beneficial to borrowers with lower credit scores because FHA loans tend to allow lower minimum credit scores. The loans and credit come in many forms ranging from something as simple as a credit card to more complex lending like mortgages auto and student loans. A HELOC is.

No security deposit required. Repay over 12 - 36 months. 000 - 500 Why we like it.

The best unsecured credit card for bad credit is the Credit One Bank Platinum Visa for Rebuilding Credit because it has a 300 minimum credit limit and you dont have to put down a security deposit. No additional deposit. No credit history or credit check required.

Compare our credit cards for bad credit to find a card to help rebuild your credit. In this case consider saving for a larger down payment and working to improve. Credit unions and online lenders offer loans to those with poor credit but the threshold for whats considered a creditworthy borrower.

Initial deposits can be from 200 to 3000. Or as a credit line. Above 36 will make it harder to borrow money and you may not be able to get a mortgage if your DTI exceeds 43.

Bad credit loans are loans for people with bad or poor credit. Unsecured credit cards for poor credit can help you rebuild your credit if used responsibly. For a PTI ratio.

Happy Money formerly Payoff bad credit loans are specifically available to help borrowers eliminate. Lenders use borrowers FICO scores along with other details on borrowers credit reports to assess credit. Our guide to bad credit car loans offers an overview of getting a loan when you need wheels but your score isnt up to speed.

A higher score indicates a. These are some of the reasons why you might be considered as having bad or poor credit. You will be able to qualify for better interest rates on loans and credit cards as well as better rewards.

Credit lines range from 550-1350 which double to 1100-2700 after your account qualifies. After 9 months we review your account for a credit line increase. See if you are pre-approved within minutes without affecting your credit score.

Youll have to wait three days after requesting an advance to access money from your personal line of credit. The Credit One Visa also gives cardholders 1 cash back on select purchases in return for paying 99 in annual fees 75 the first year. We have the best credit card offers for those with poor credit.

If you need money fast Alliant Credit Union typically makes same-day online personal loans between 1000 and 50000. Double your credit line by making at least your minimum payment on time each month for the first 7 months your account is open. You can increase your credit line at any time by adding additional money to your security deposit up to 3000.

Has a fixed interest rate and regular monthly payments are expected. 1000 to 40000. A line of credit can be a good choice when you need to tackle a large expense and want to avoid the high rates of credit cards.

Other than its origination fee Happy Money doesnt charge application and fees fees or prepayment penalties or late. Home equity line of credit HELOC calculator. However many lenders prefer a DTI below 36 the lower the better.

Debtzilla Game Review Meeple Mountain

Pin Page

2

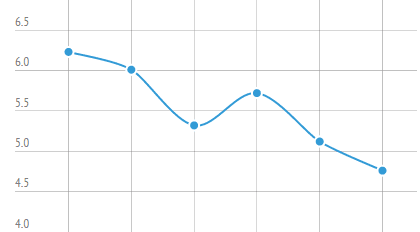

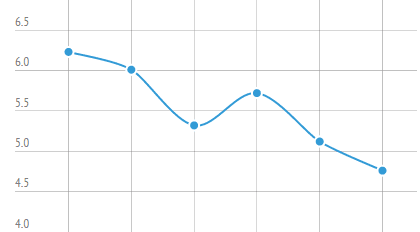

Sc 20201231

Low Rate Personal Loans Compare And Get The Best Deal

Guaranteed Startup Business Loans No Credit Check Business Funding

Best Of Money Awards 2022 Moneygenius

Pin On Financial Motivation

No Credit Check Business Loans Online Guaranteed Instant Approval

Guaranteed Startup Business Loans No Credit Check Business Funding

Best Of Money Awards 2022 Moneygenius

Pin On Pool Pricer Articles

Sc 20201231

Basics Of Purchasing Inventory Through A Line Of Credit Quick Loans Direct

Restaurant Loans Restaurant Equipment Financing Bad Credit

Bad Credit Business Loans Guaranteed Approval

Pin On Financial Education